The Hunt For Dividends May Drive Demand for Self-Directed IRAs

When it comes to retirement investing, it’s all about generating inflation-resistant income – otherwise what’s the point? And most Self-Directed IRA investors who have been around a few market cycles know that dividend and interest income are tremendously important to creating stability in a roiling market.

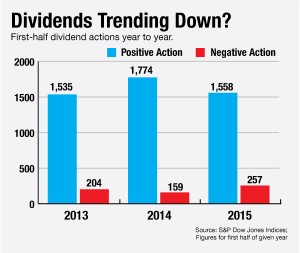

B ut for investors who are still stuck in the publicly traded stock market – the usual menu of mutual funds and blue-chip stocks most of us think of when we consider Self-Directed IRA investing, we may be entering a bit of a dividend dry spell. Dividends are drying up all over the market, according to a recent article published in Financial Planning magazine.

ut for investors who are still stuck in the publicly traded stock market – the usual menu of mutual funds and blue-chip stocks most of us think of when we consider Self-Directed IRA investing, we may be entering a bit of a dividend dry spell. Dividends are drying up all over the market, according to a recent article published in Financial Planning magazine.

Chart: Financial-Planning.com

This research indicates that an increasing number of companies are decreasing their dividends, while an increasing number of companies are cutting their dividends.

For some companies, it could be because revenues and/or operating profits are starting to deteriorate as the economic cycle matures. For others it could mean that they are seeing opportunities to reinvest cash in the business at better than market rates of return. At least, this is our hope! This may well be the case for the companies that issued share buybacks – a classic gesture of bullishness and confidence on the part of company management.

For income-focused investors, however, it means trouble: The lower dividends go, the more volatile stocks are likely to be, compared to their total return numbers, and the less stable conventional retirement accounts are likely to become, from the perspective of providing the account owner with a reasonably reliable stream of retirement income over many years out of the work force.

That’s where the self-directed IRA comes in: The self-directed strategy breaks the chains that tie down retirement portfolios to the current low dividend levels available in diversified stock portfolios, and liberates investors to pursue a true ‘go anywhere’ strategy with a much broader variety of asset classes.

These asset classes, of course, include proven income vehicles:

- Direct IRA ownership of rental real estate

- Direct lending

- Private banking

- Mortgage lending

- Hard-money lending

- Tax liens and certificates

- Closely held businesses

- C Corporations

- LLCs

- Partnerships

- Non-publicly-traded REITs

- Business development companies

[tweetthis twitter_handles=”@iraexpert” hidden_hashtags=”#SelfDirectedIRA”]Adapting Self-Directed IRA strategy doesn’t mean you have to give up..[/tweetthis]

Meanwhile, adapting a self-directed IRA strategy doesn’t mean you have to give up your more conventional approach with the blue chip stocks, investment grade bonds and other holdings that form the core of most American’s personal retirement portfolios. The two approaches can work very well side-by-side, if that is what you are comfortable with. For example, there’s nothing wrong with a barbell strategy that devotes part of your portfolio explicitly to maximizing current income, with another part of your portfolio maximizing liquidity for the next year or two, and the remainder devoted to generating long-term growth in the effort to outrun the cancer of inflation and preserve your purchasing power in out years.

American IRA, LLC is a national leader when it comes to helping investors use unconventional strategies and asset classes beyond stocks, bonds and mutual funds to generate both income and capital gains. To learn more, call now at 866-7500-IRA(472) or visit our vast library of informational articles and blog posts, at www.americanira.com.

We look forward to working with you.

Image by: presentermedia.com