Posts

American IRA at FinCon 2024: Unlocking Opportunities in Fintech

American IRA is gearing up for an incredible experience at the…

In Case You Missed It: Show Notes from The IRA Café Webinar Series – Chris Cornett

In our latest installment of the IRA Café webinar series, hosted…

In Case You Missed It: Show Notes from October 8 Webinar Series – Q&A Session & Updates

Asheville, NC – During our latest IRA Café webinar series,…

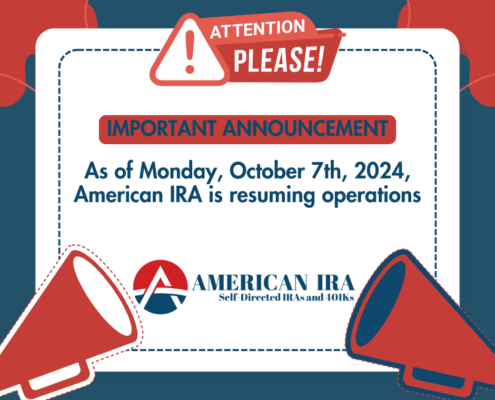

Hurricane Helene Update: American IRA Operations Resuming

As we continue to navigate the ongoing effects of Hurricane Helene,…

In Case You Missed It: Show Notes from September Webinar Series – Gregory Emmer

Asheville, NC – In our latest IRA…

In Case You Missed It: Show Notes from September Webinar Series – Charlie Wessel

Asheville, NC – In our latest webinar hosted by American…

Celebrating Excellence: Rebekah Schram Nominated for Executive of the Year 2024

At American IRA we couldn’t be more thrilled to announce an…

In Case You Missed It: Show Notes from the August Webinar Series – Charlie Wessel

American IRA’s most recent webinar featuring Charlie Wessel…