Attention Realtors: Self-directed IRAs Offer Realtors’ Clients Additional Capital for Investments

Very few real estate investors realize that their self-directed IRA investment options go beyond stocks, bonds and cash. Opening up a self-directed IRA can add diversification to their portfolio and boost the cash they have available to purchase real estate – provided your clients obey the rules.

The question of where to get more funds to invest in real estate is an increasing challenge. Government backed loans are on hold entirely until the government shutdown is over. The good news is that your clients can use their self-directed IRA funds to invest in real estate.

Making the right real estate investments now can significantly improve the ‘quality of life’ for your clients in their retirement years. If your clients have more money to invest with, you can close more real estate deals. We are here to help, just let your clients know that they can use their retirement accounts as a funding source for real estate purchases, then have them call our office and we will explain the process and help them get their self-directed IRA accounts open and funded. So why would your clients want to change the way they are investing with their IRA?

- Stocks are facing increasing uncertainty as Washington sits in a seeming deadlock.

- Interest rates for bonds have been less than 1% making it a nearly valueless investment.

- Money markets are sometimes netting negative interest after your clients pay their fees.

- New required health care premiums are likely to cause a swell in available real estate as people look to downsize in order to obtain the additional cash they need to cover this new tax. Getting funding in order now will be the key to obtaining great properties at a great price.

Happier clients equal repeat business

We have heard from so many real estate professionals about how their sales increased because they were savvy enough to build a client base of investors who learned to use their self-directed IRAs to purchase real estate. It has turned into a winning formula for all involved.

Sound difficult? Not at all. There are 3 easy steps to opening a self-directed IRA:

- Complete an application

- Transfer, Rollover, or Contribute funds to their new self-directed IRA account

- Decide what they want to invest in

Once the account is open and funded, your clients can begin purchasing real estate with their self-directed IRA. They just need to avoid a few simple rules as outlined by the IRS:

- They are not permitted to provide services to their IRA including, but not limited to:

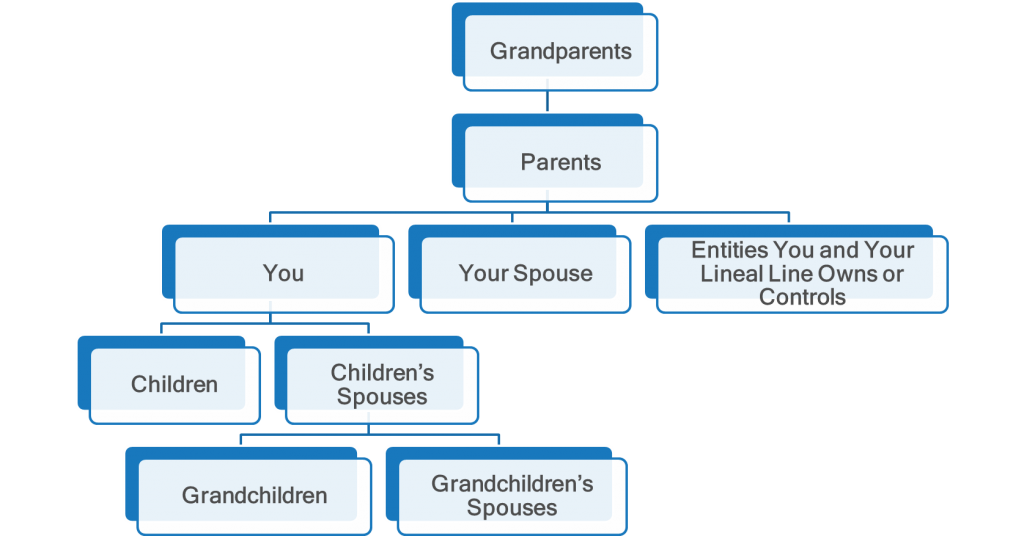

- Their IRA cannot do business with:

Thinking outside the banks

Your clients should also be aware that they can loan money to other investors with their IRAs. We are seeing a huge increase in the amount of secured loans our clients are issuing via their self-directed IRAs to private investors. These private loans have become exceedingly popular as traditional loans are getting more difficult to obtain. Private loans, under the right circumstances, can offer the private lender a steady income stream via interest rates that generally range from 7 to 10 percent and they offer the borrower much needed funds to get those real estate deals moving.

The key to success in this economy might just be working together to meet each other’s needs.