With S&P Earnings Yields Low, Now’s the Time to Diversify Using a Self-Directed IRA

It’s up! It’s down! It’s all around! The last couple of weeks on the stock market has been entertaining, if nothing else. But it is easy to maintain a healthy perspective on stock market volatility if one’s own retirement prospects are not hanging in the balance with every sickening swing in prices. And this underscores the value proposition of Self-Directed IRA investing and alternative asset classes: Diversify enough, and you do not have to worry much about it.

On December 26th, 2018, the stock market as measured by the Dow Jones Industrial Average rose by more than a thousand points – logging its biggest single-day increase in history.

But just days before, the Dow logged one of its biggest single-day losses.

And it does not matter. What matters is this: Over the past ten years, the S&P 500 has delivered an annualized return of more than 14 percent. It is delivered nine positive years in a row, prior to 2018. As of this writing, 2018 will see U.S. large cap stocks finish underwater by about 7 percent, barring any major market moves in the next few days.

The 7 percent loss we will probably have for 2018, and the big single day moves over the last few weeks are healthy reminders: The market is risky. The market did not suddenly become risky: The market was risky all along!

And, paradoxically, stock markets are riskiest precisely when they appear the safest. That’s when stock prices get bid up the most.

Self-Directed IRAs Help You Get Off the Volatility Wagon

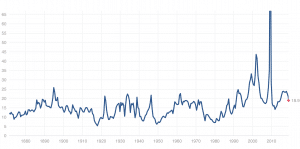

But large-cap U.S. stocks – the ones measured by the Dow Jones Industrial Average (which is a very narrow reading of just 30 ultra-big companies) and the S&P 500 appear to have outstripped earnings by a large margin: Stock prices increased by about 14 percent per year, but earnings did not increase that much: The trailing price-to-earnings ratio for the S&P 500 is 18.7 percent. Not crazy high, by any standard, but certainly toward the top of its long-term historical range, discounting some more recent outlying circumstances.

Price-Earnings Ratio, S&P 500 Index.

Source: Multpl.com.

Now, let’s look at this a different way: What is the earnings yield for U.S. large cap stocks, and what’s been the trend?

Earnings Yield Is What Counts – In or Out of Self-Directed IRAs

Earnings yield is what really counts – it is what real estate investors try to predict when they determine cap rates on investment properties, it is something all equity investors should be taking a look at no matter what the asset class is: The total all-in net earnings, divided by the stock price.

Currently, the earnings yield on the S&P 500 is 5.29%. That’s the return investors can expect going forward, if there are no changes in P/E multiples.

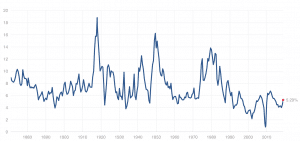

S&P 500 Earnings Yield, as of 26 December 2018

Source: Multpl.com

As you can easily see from the historic earnings yield chart, the 5.29 earnings yield figure is towards the bottom of its historic range, with the exception of the 2008 recession and the days following the burst of the dot.com

Subtract investment expenses from that – expense ratios, 12(b)1 fees, bid/ask spreads and commissions – and that looks a lot more like 4 to 4.5%.

Well, that’s ok, in the long run. But in the short run, you are still facing an awful lot of volatility in stocks: A market that can gain 1000 points in a single day, as it did yesterday, can lose them just as easily. And a market that lost 35 percent in 2008 can do it again in 2019, no problem.

A net earnings yield after expenses of 4 to 4.5 percent is not enough compensation, given the very real risks, to justify an outsize concentration in stock mutual funds and ETFs for most people. Not when there are a number of other asset classes that can generate similar returns with lower historic levels of volatility. That’s essentially bonds territory. Banks are lending on houses at that rate – and getting the security of real estate in the process.

A self-directed retirement account allows you to quickly and efficiently spread your assets out over several unrelated types of assets – many of which have similar earnings yields or expected returns and lower or equivalent levels of volatility. Even more have similar expected earnings and similar volatility levels, but they tend not to fall at the same time as stocks.

When you hold volatile assets in combination in your portfolio, the volatility of the multiple asset classes, constantly pulling in different directions, tends to even out. When stocks zig, real estate, private lending, precious metals or other alternative asset classes zag. The overall volatility of the portfolio tends to cancel out, but you still get the benefit of earnings in each asset class over time.

Self-Directed IRAs let you diversify away from stocks and into:

- Direct real estate ownership and rental

- Oil and gas

- Partnerships

- Tax liens and certificates

- Farms and ranches

- Timber and minerals

- Closely-held corporations

- LLCs

- Private lending

- Mortgages

- Venture capital

- Private debt placement

- Private equity

- Hedge funds

- Crypto assets

And many others.

Interested in learning more about Self-Directed IRAs? Contact American IRA, LLC at 866-7500-IRA (472) for a free consultation. Download our free guides or visit us online at www.AmericanIRA.com.